No Endgame: SARS stalemates taxpayers ceasing tax residency

There may be a strange game of chess being played with taxpayers who are trying to cease their South African tax residency, with the result of keeping them “trapped” as tax residents for no legitimate reason.

“We have seen this often and especially in unassisted non-resident applications that are rejected for reasons that are both contradictory and inconsistent,” says Thomas Lobban, Head of Cross-Border Individual Tax at Tax Consulting South Africa.

However, approval is still possible for such rejected applications if the taxpayer follows the correct processes and fully complies with all legal requirements. The taxpayer can, where appropriate, request that SARS review its decision and carry the application forward on the correct basis.

The stalemate

Lobban warns that taxpayers applying to be non-residents for tax purposes will need to be prepared for an increasingly likely first-time rejection but must be diligent in pursuing approval. “SARS cannot delay or reject a matter without good and lawful cause where you are compliant and qualify to cease your tax residency. With evidence, due diligence, and enough competence, one can outmanoeuvre an errant SARS official and avoid an absurd stalemate situation,” he says.

In chess terms, a stalemate is a situation where a player is not in check and has no legal move. According to Lobban, this seems to be the situation being played out with an increasing number of non-resident applications. Even where there is no legal reason for SARS to reject an application, it still happens.

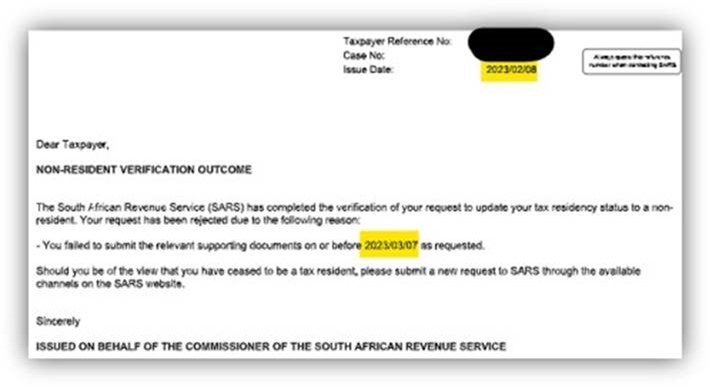

“Examples that we have seen include rejections on the basis of requested information not being submitted even when it was, or a rejection on the basis of a deadline that has not yet passed, among many others” says Lobban.

What should taxpayers do to succeed?

If SARS is indeed on a mission to find a reason to stall or reject a taxpayer’s efforts to cease tax residency, as unlikely as this should be, then emigrating South Africans should minimise those reasons as far as possible.

Says, Victoria Lancefield, the firm’s Director of Expatriate Tax and Banking Engagement: “Ceasing tax residency is a fairly tight process with only 21 days to prepare, reconcile and submit the often substantial body of documents SARS requests.” How much evidence SARS requires will depend on the complexity of the taxpayer’s financial matters and tax affairs.

Those ceasing tax residency should take extra care in the following areas:

- Financial review. A financial review is a preparatory step that does not involve SARS. Taxpayers should identify and detail their worldwide sources of income; entire portfolio of local and foreign assets; all financial and tax structures, such as trusts, business entities or beneficial ownership arrangements; and any other relevant financial details of which SARS will likely be aware through global third-party data sources. “This step will protect applicants from being rejected on the basis of not being forthcoming and transparent about their wealth,” says Lancefield.

- Tax diagnostic. A tax diagnostic is a preparatory step that queries the taxpayer’s standing with SARS but, being a fairly automated and typical exercise, does not trigger any audit on them. Taxpayers will review their tax status to ensure they have fully disclosed their worldwide wealth, that their tax submissions are up to date, that their account balance is paid up, and that they are not otherwise non-compliant. “A preliminary check-up of this nature is critical to ensure you can correct any non-compliance that would result in rejection before making your official submission,” says Lancefield.

- Informing SARS. An aspect of informing SARS that one is ceasing tax residency is done by completing a Registration, Amendments and Verification (RAV01) form on eFiling or by appointment at a SARS branch and, at this point, SARS becomes directly involved in the process. Because the RAV01 is used for other purposes apart from ceasing tax residency, and SARS published a 54-page manual on how to complete it correctly, taxpayers must be particularly careful when doing so. “An incorrect RAV01 is a good enough reason to reject the application before it ever gets off the ground,” says Lobban.

- Communication. Communication with and negotiating SARS takes energy and persistence. SARS may very well reject an application to cease tax residency on reasonable and valid grounds. So, an important skill is to be able to distinguish when this is true and when delaying tactics are involved. In the latter case, taxpayers must be prepared to stand their ground and outmanoeuvre any attempts by SARS to incorrectly deny or delay their application. “Unfortunately, these skills are generally acquired through extensive experience so, without a professional hand to guide the process, a first-time applicant may find themselves in a frustrating stalemate that they just cannot break,” says Lobban.

Going for checkmate

SARS will inevitably carry out some form of verification process on a taxpayer ceasing their South African tax residency, based on their submitted information, and could well reject an application for the slightest perceived shortcoming.

“It is certainly understandable as this is a complex process involving legal and financial components. However, inconsistent and unreasoned rejections are making it extremely difficult for taxpayers to follow the process in an efficient timely manner.” says Lancefield. “We have noticed a trend of what could be seen as delay-by-rejection tactics being employed in certain cases, so we are advising those ceasing tax residency to be extra diligent and thorough when applying.”

By playing with the intent to win, taxpayers can overcome this latest hurdle.