SARS Is Sticking to Its Promise of Dramatically Faster Turnaround Times

The South African Revenue Service (SARS) recently made several changes to its Tax Compliance Status (TCS) process. According to their media statement on 3 May 2023, SARS states that these changes, or “enhancements”, aim to “dramatically improve turnaround times” for compliant taxpayers and traders seeking to transfer funds out of South Africa.

Director of Expatriate Tax and Banking Engagement

SARS Tax Compliance and Process Supervisor

Swift turnaround times for the processing of TCS pins have been sorely lacking, and with the implementation of these enhancements, it does appear that SARS is sticking to this promise.

What is a TCS pin and when would I need one?

Simply, a TCS pin is a modern version of a Tax Compliance Certificate. It allows third parties, such as an individual, a company, or a government entity, to verify whether you or your business, is tax compliant. There are several scenarios where you may require a TCS pin, including tender applications and confirmation of your good standing with SARS.

However, the most common need for a TCS pin is approval for transferring funds out of the country, formerly known as a Foreign Investment Allowance. Resident taxpayers require to provide the clearance certificate when remitting funds above their R1 million Single Discretionary Allowance out of the country. Non-resident taxpayers require the clearance certificate when remitting any funds out of the country.

Geared up processing times

Previously, the turnaround time for a TCS pin application was 21 business days. However, if any verification or additional documents was required, the applicant would have to wait an additional 21 days.

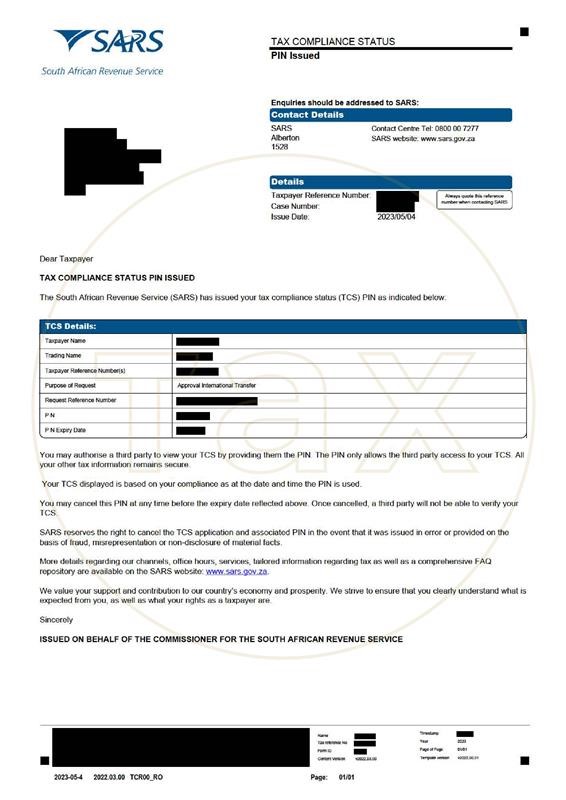

Following SARS’ announcement of the enhancements to their TCS process, we are seeing an improvement in these processing times, as per the example below:

This application was submitted on 25 April, and approved in a mere 6 business days, on 4 May 2023 – a significantly expedited turnaround time indeed.

Faster turnaround – at the cost of a more stringent application process

Unfortunately, the process for applicants is far more cumbersome, with more questions for taxpayers to answer and plenty more mandatory fields to fill out, especially for the declaration of local and foreign assets and liabilities section. As SARS has mentioned, this “beefed up” process aims to make things “easier for compliant taxpayers and traders, and much more challenging for those who are non-compliant.” However, with the stringent application process here to stay, one may forgive its burdensome nature, if SARS keeps up the expedited processing times.

Time will tell

Time will only tell if this much-needed swiftness will continue for now, though, it seems that SARS is sticking to its promises and aims for this enhanced TCS process.

As with any new process or change, there are certain aspects which remain ambiguous and complex, and it is recommended that these applications be addressed by a qualified tax practitioner or attorney.