SARS IS NOW OFFICIALLY ISSUING CONFIRMATION OF TAX NON-RESIDENCY LETTERS

As a Tax Resident, you are legally required to submit tax returns to SARS every year and declare your worldwide earnings (local and foreign) and then claim any exemptions or tax credits on the foreign earnings.

Importantly, if you do not formally note yourself as tax non-resident with SARS(South African Revenue Service), then you will be seen as a tax resident in South Africa. Even if you have broken our tax residency tests, being the ordinarily residence test and physical presence test, or there is a Double Taxation Agreement in place, these factors are not going to automatically change your status to tax non-resident. The only way to change your tax status is to formally undergo the relevant legal processes through SARS.

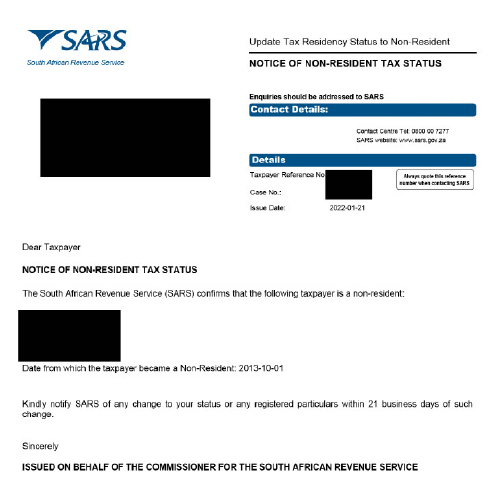

SARS has recently introduced a “SARS Non-Resident Tax Status Confirmation Letter” (see example for reference). This letter was not previously a requirement of the emigration process.

WHAT IS A

NON-RESIDENT

TAX STATUS LETTER?

The SARS Notice of Non-resident Tax Status Letter. This letter confirms that you have ceased to be a tax resident of South Africa and indicates the effective date that tax residency was ceased. Taxpayers who have previously ceased tax residency and obtained the Emigration Tax Clearance Certificate (ETCC) or Tax Compliance Status (TCS) PIN for Emigration also require this letter.

To be able to apply for the SARS Notice of Non-Resident Tax Status Letter, one must meet the legal requirements to be considered a non-resident of South Africa for tax purposes, update their tax status and complete the verification process with SARS. SARS will then issue the confirmation letter.

When moving funds abroad, taxpayers must apply for the newly introduced Approved International Transfer (AIT) PIN with SARS, which is only valid for 12 months from the date of issue. If you apply for the AIT PIN as a non-resident taxpayer, the above-mentioned letter is a strict requirement.

**Kindly note that this change took effect on 24 April 2023, replacing the TCS PIN for Emigration and the Foreign Investment Allowance (FIA) PIN with the new AIT PIN.

WHAT IS A

NON-RESIDENT

TAX STATUS LETTER?

FAQ: Non-Resident Confirmation Letter for South African Expatriates

- As a Tax Resident, you are legally required to submit tax returns to SARS every year and declare your worldwide earnings (local and foreign) and then claim any exemptions or tax credits on the foreign earnings.

- Importantly, if you do not formally note yourself as tax non-resident with SARS, then you will be seen as a tax resident in South Africa. Even if you have broken our tax residency tests, being the ordinarily residence test and physical presence test, or there is a Double Taxation Treaty in place, these factors are not going to automatically change your status to tax non-resident. The only way to change your tax status is to formally undergo the relevant legal processes through SARS.

- SARS has recently introduced a “SARS Non-Resident Tax Status Confirmation Letter” which is legal proof that you have ceased your tax residency in South Africa.

- Commonly required documents include:

- A passport stamp evidencing your date of departure from South Africa and arrival in your new host country.

- Proof of tax residency in your host country

- A written request or formal declaration of confirming that you have ceased tax residency.

- A Letter motivating as to why you or SARS should approve your status for non-tax residency

- The processing time varies but typically takes between 8 -10 weeks after all required documentation is submitted and accepted. Delays can occur if additional information is requested by SARS

- Without formal confirmation, SARS will still consider you a tax resident, and you will be liable for tax on your worldwide income. The letter is essential for protecting yourself against unintended tax liabilities and complications with SARS.

- It renders your worldwide income non-taxable in South Africa, but you will still be liable for taxes on income sourced from within the borders of South Africa, such as rental income from and immovable property situated in South Africa

BENEFITS

OF CEASING YOUR TAX RESIDENCY

After ceasing your tax residency, you will start to enjoy the many benefits of being an SA tax non-resident, hence the importance of having all the necessary and correct documentation.

Financial Emigration also provides the rare opportunity to encash your retirement annuity in full once you have been tax non-resident for 3 years.

- You will be taxed on South African sourced income only.

- Capital gains tax will only be applicable on fixed property located in South Africa /assets of permanent establishment.

- No other capital gains tax.

- No world-wide tax even on remittances.

- No donations tax and / or estate duty.